jefferson parish sales tax rate

The following local sales tax rates apply in Jefferson Parish. Sales Tax Portal Lookup Sales.

The bills are usually mailed in late november of each year.

. Most due apr 1 jefferson parish due mar 1. Jefferson Details Please consult your local tax authority for specific details. To view rates and forms for Jefferson Parish CLICK HERE.

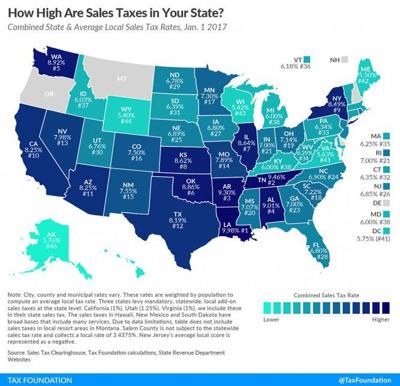

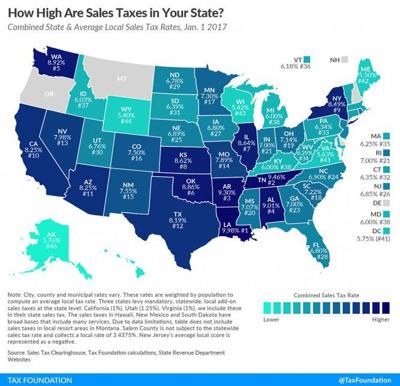

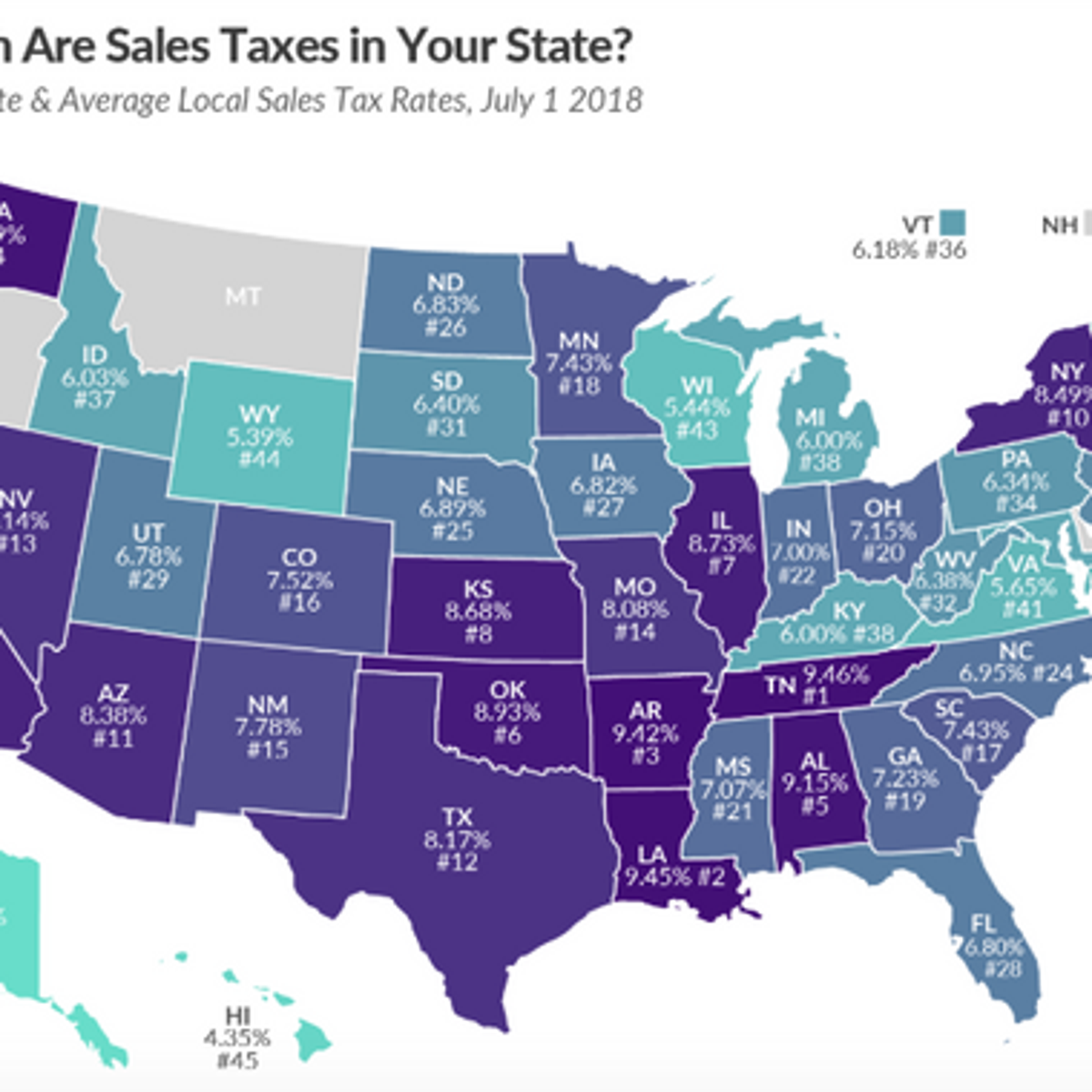

The Income Approach calculates how much rental cash flow likely would be generated from income-generating real estate. The 2018 United States Supreme Court decision in South Dakota v. 7 rows Tax Comb.

The Louisiana sales tax rate is currently. Jefferson Parish Sales Tax Rates for 2022. Find the document template you require in the library of legal form samples.

The following local sales tax rates apply in jefferson parish. The Jefferson Parish sales tax rate is 475. Higher maximum sales tax than 83 of Louisiana counties Higher maximum sales tax than 98 of counties nationwide.

Decrease in Overall State Sales Tax Rate to be Effective July 1. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Louisiana manufacturers will no longer pay sales and use tax on qualified machinery and equipment ME.

The Avondale sales tax rate is. The December 2020 total local sales tax rate was also 9200. With the exception of the Airport District Tax salesuse tax rates are uniform throughout the Parish and are in addition to the salesuse tax imposed by the State of Louisiana.

Sales Tax Rates - July 1 2018. Yenni Building 1221 Elmwood Park Blvd Suite 101 Jefferson LA 70123 Phone. Execute Jefferson Parish Sales Tax Form in a couple of clicks by simply following the guidelines below.

Cities andor municipalities of Louisiana are allowed to. The Sales Comparison method involves contrasting present like houses sale prices in the same community. Heres how Jefferson Parishs maximum sales tax rate of 112 compares to other counties around the United States.

What is the rate of Jefferson Parish salesuse tax. Jefferson Parish Government Building 200 Derbigny Street Suite 1200 Gretna LA 70053 Telephone. This rate includes any state county city and local sales taxes.

The jefferson parish sales tax rate is. Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Jefferson Parish totaling 575. East Bank Office Joseph S.

There are state and parish sales taxes calculated in this way. The current total local sales tax rate in Jefferson Parish LA is 9200. What Is The Sales Tax In Jefferson Parish.

This is the total of state and parish sales tax rates. Local Rate State Rate Total. Free jefferson parish property records search.

Sales Tax Calculator of Louisiana for 2020 The state general sales tax rate of Louisiana is 445. According to Jefferson Parish Louisianas minimum combined 2022 sales tax rate of 9 percent. Louisiana has a 445 sales tax and Jefferson Davis Parish collects an additional 5 so the minimum sales tax rate in Jefferson Davis Parish is 945 not including any city or special district taxes.

What is the sales tax rate in Avondale Louisiana. Revenue Information Bulletin 18-016. West Bank Office 1855 Ames Blvd Suite A.

Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. There is currently a 4 sales tax rate in Louisiana. 3 rows Parish-Wide SalesUse Tax Rates Parish Council School Board Law Enforcement District.

350 on the sale of food items purchased for preparation and consumption in the home. The exact property tax levied depends on the county in louisiana the property is located in. The Parish sales tax rate is.

Wayfair Inc affect Louisiana. Jefferson Davis Parish Sales Use. 35 on the sale of prescription drugs and medical devices prescribed by a physician.

Did South Dakota v. The Jefferson Parish Sales Tax is 475 A county-wide sales tax rate of 475 is applicable to localities in Jefferson. What is the sales tax rate in Jefferson Parish.

The Louisiana state sales tax rate is currently 445. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes. This table shows the total sales tax rates for all cities and towns.

975 The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish Groceries are exempt from the Jefferson Parish and Louisiana state sales taxes Jefferson Parish collects a 475 local sales tax the maximum local sales tax allowed under Louisiana. You can find more tax rates and allowances for Jefferson Parish and Louisiana in the 2022 Louisiana Tax Tables. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

Parish E-File Submit state and local sales and use tax returns and remittances from one centralized site Register a Business Online applications to register a business. 475 on the sale of general merchandise and certain services. The total sales tax rate in any given location can be broken down into state county city and special district rates.

2020 rates included for use while preparing your income tax deduction. If Jefferson Parish property tax rates have been too costly for your revenue and now you have delinquent property. According to Jefferson Parish taxes are applied at four percent.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is 92. The Parish of Jefferson the Jefferson Parish School Board and other political taxing subdivisions of Jefferson Parish levy local salesuse taxes. This is the total of state parish and city sales tax rates.

Opry Mills Breakfast Restaurants. The latest sales tax rate for Jefferson LA. The minimum combined 2022 sales tax rate for Avondale Louisiana is.

Louisiana Sales Tax Small Business Guide Truic

Louisiana S Regressive Tax Code Is Contributing To Racial Income Inequality Louisiana Budget Project

Brief House Bill 514 Sales Tax Extension Louisiana Budget Project

La Form 8071 New Orleans 2016 Fill Out Tax Template Online Us Legal Forms

Jefferson Parish Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Indiana Sales Tax Rates By City County 2022

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

Louisiana Car Sales Tax Everything You Need To Know

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

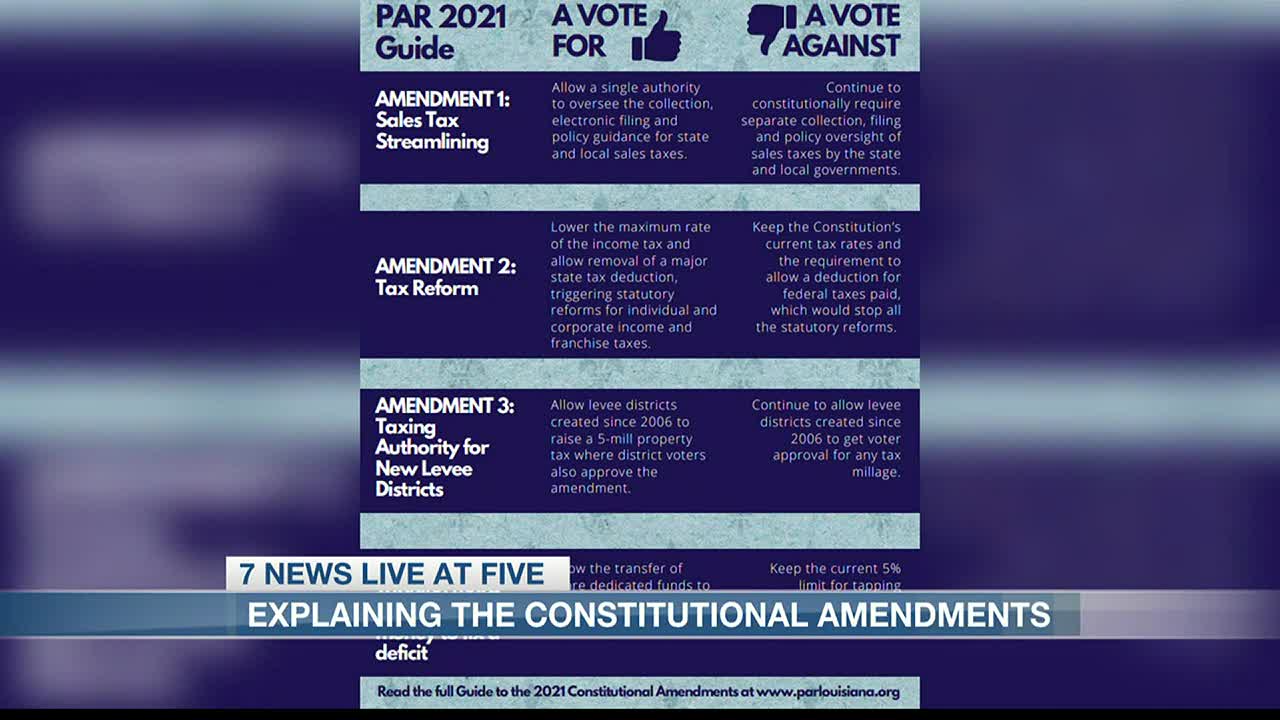

Breaking Down Four Proposed Constitutional Amendments In Upcoming Election

Louisiana Sales Tax Rates By City County 2022

Faqs Jefferson Parish Sheriff S Office La Civicengage

Louisiana Sales Tax Rates By County

Louisiana Sales Tax Calculator Reverse Sales Dremployee

Ebr 0 5 Sales Tax Increase Effective April 1st Faulk Winkler Llc